Finding an accountant to control your bookkeeping and file taxes is a big selection. Fortunately, you won't need to deal with the look for by yourself.

Will be the private lender obligated to send me a 1098 (they’re not in the lending business, just an individual which includes the cash offered) ?

Even though you don’t get a kind, the IRS nonetheless expects precision. You are able to continue to report home finance loan interest and deduct home finance loan expenditures should they qualify.

Comprehending how to acquire your 1098 Property finance loan Fascination Statement is crucial for correctly filing taxes and claiming deductions. This doc, provided by your property finance loan lender, facts the curiosity compensated with your mortgage loan in the last yr.

IDR processing has resumed for IBR, PAYE, and ICR purposes for borrowers who file taxes as solitary, or married without any profits. All other IDR applications will continue being on hold right now. We are going to notify you after your application has long been processed.

An fascination recipient, such as a receiver of details, can designate a certified particular person to file Type 1098 and to provide an announcement on the payer of report.

Supporting Identification Paperwork need to be first or copies Accredited with the issuing agency. Unique supporting documentation for dependents has to be included in the application.

The IRS has updated its suggestions for Sort 1098, highlighting the variations in reporting home loan curiosity and addressing even more specificities:

Your check here assertion might be readily available online about the center of January, leaving you loads of time and energy to reference it for filing your taxes.

MOHELA has your tax data from each MOHELA plus your prior servicer for 2024. In case you experienced an adjustment from 2023 for the duration of 2024, the adjustment might be included in your full reportable volume. If you transferred from MOHELA to Aidvantage or EdFinancial and so are now not serviced by us:

In the event you compensated a lot less than $600 in fascination to any of one's federal loan servicers, you are able to Make contact with Each individual servicer as needed to figure out the precise number of curiosity you compensated in the course of the year. How will reporting my scholar loan curiosity payments on my 2023 taxes profit me?

The shape contains aspects including full interest paid, factors compensated around the house loan, and the exceptional home finance loan principal. These figures are necessary for completing Timetable A of Sort 1040, where by itemized deductions are reported.

They may need to file a corrected Variety 1098 Along with the IRS, which could assist avoid troubles with the tax return.

Report the entire details on Kind 1098 for the calendar 12 months of closing whatever the accounting strategy used to report factors for federal money tax needs.

Mara Wilson Then & Now!

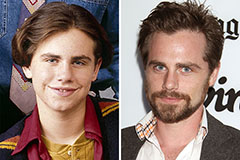

Mara Wilson Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now!